ITM Branches: Why You Need Them

by La Macchia GroupFinancial institutions are always on the lookout for ways to improve their customer experience while optimizing their operational efficiency and saving on costs. One solution that has been gaining traction in recent years is ITM (Interactive Teller Machine) branches. ITM branches, also known as remote teller branches, are self-service banking kiosks that allow customers to interact with tellers remotely. The tellers will work in a centralized hub, typically a main office or operations center, but can provide service to consumers at ITM branches via video chat.

There are several reasons why financial institutions need ITM branches. Not only do these branches benefit your consumers, but they will help your financial institution in more ways than one. Let’s explore these benefits below!

Enhanced Consumer Experience

ITM branches offer a new level of convenience and accessibility to consumers. They provide extended hours of operation, and allow consumers to perform a range of services such as:

- Withdraw and deposit cash

- Pay bills and loans

- Open new accounts

- Get a new debit/credit card

- Get financial advice and more!

Consumers who may not have access to traditional branch locations or who prefer to use technology to manage their finances can benefit greatly from ITM branches. With the help of video tellers, customers can quickly and easily get assistance with complex transactions or ask questions about their accounts. ITMs give consumers the freedom and flexibility to do their banking when and how they want.

Advantages for Your Financial Institution

Building and operating a traditional brick-and-mortar branch can be a lengthy and expensive investment for financial institutions. On the other hand, ITM branches require less physical space, less labor and the cost of maintaining them is relatively low. Additionally, ITM branches can be built to serve multiple locations, which means financial institutions can expand their reach without incurring the costs associated with opening new branches.

Not only that, ITM branches can increase operational efficiency as well. They can help streamline the operations of financial institutions by reducing the workload of traditional branches. With the help of video tellers, consumers can perform most of the transactions that they would typically do in-person, and this can free up the time of branch staff to focus on other tasks.

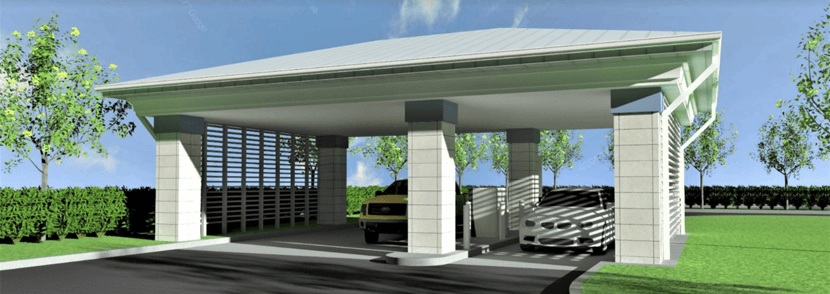

This example of a staff-less walk up/drive up ITM Branch gives members the opportunity to use the provided services independently, or with the help of a Remote Teller.

As you can see, ITM branches are one of the newest ways financial institutions are enhancing the consumer experience while saving on costs and optimizing operational efficiency. La Macchia Group’s experience with financial facilities and ITM installations make us the ideal partner for your business to stay ahead of the competition while attracting new customers wanting a more flexible, digital lifestyle.

.png?width=248&height=73&name=Logo%20w%20Tag%20-%20Color@300x%20(1).png)