Affinity Federal Credit Union

Antinea,

Thank you for taking the time to discuss the benefits of Micro branches within a hub and spoke model. We agree with you that they can help credit unions expand their presence, provide more accessible services, and better engage with their members, while maintaining cost-efficiency and remaining competitive in the financial market. Here are several benefits we have found at La Macchia Group as well as some successful floor plans below.

MICRO BRANCHES IN A HUB AND SPOKE BRANCH NETWORK MODEL

Increased accessibility: Micro branches can be situated in underserved areas where traditional banks may not have a presence. This allows the credit union to reach a wider pool of potential members and serve the community's financial needs.

Lower operational costs: Micro branches are typically smaller in size and require fewer staff members compared to traditional branches. This helps in reducing operational expenses, making it a cost-effective option for expanding the credit union's footprint.

Enhanced member engagement: Micro branches can provide a more personalized and localized experience to members. With smaller member bases, staff at micro branches can build stronger relationships with members, understand their unique needs, and offer tailored financial solutions.

Technology integration: Micro branches can leverage technology to offer self-service options and streamline processes, such as online account opening, loan applications, and mobile banking. This allows credit unions to provide convenient services while minimizing the physical space required for branch operations.

Flexibility and scalability: The hub and spoke model with micro branches offers flexibility in scaling up or down operations based on the needs of a particular location. It allows credit unions to experiment with new markets without significant financial risks.

Community involvement: Establishing micro branches demonstrates a commitment to community development and economic empowerment. It can contribute to financial education initiatives, sponsor local events, and support local businesses, fostering a positive image and building trust among potential members.

Competition with traditional banks: Micro branches can help credit unions compete with traditional banks by extending their reach and providing personalized services. This can attract potential members who may prefer the community-oriented approach offered by credit unions.

MICRO BRANCHES: LESS MEANS MORE

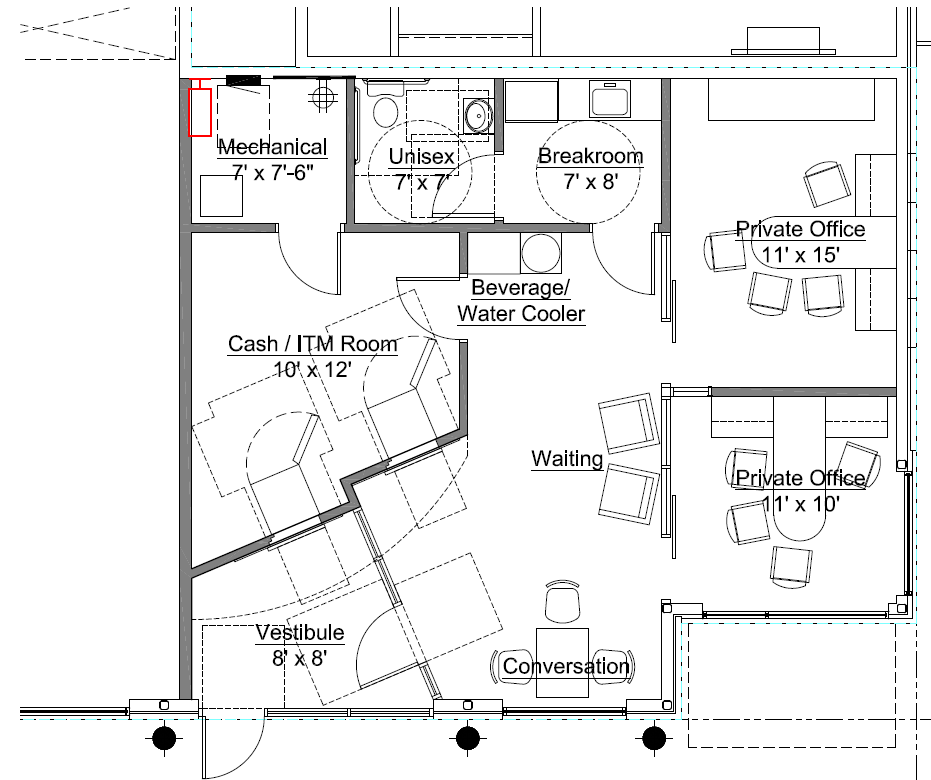

When positioned and designed appropriately, a micro branch can effectively build your brand and expose potential new consumers to your business. While this building type is full-service, the delivery model is uniquely different than that of a traditional branch. The purpose is to provide amenities in a smaller footprint with reduced staff and an emphasis on high-tech interactions. For example, Interactive Teller Machines (ITMs) allow consumers to transact business with tellers via video, accomplishing pretty much anything that can be done with an in-person teller.

TAKE A LOOK AT THESE MICROBRANCHES

ALLIANCE CATHOLIC CU

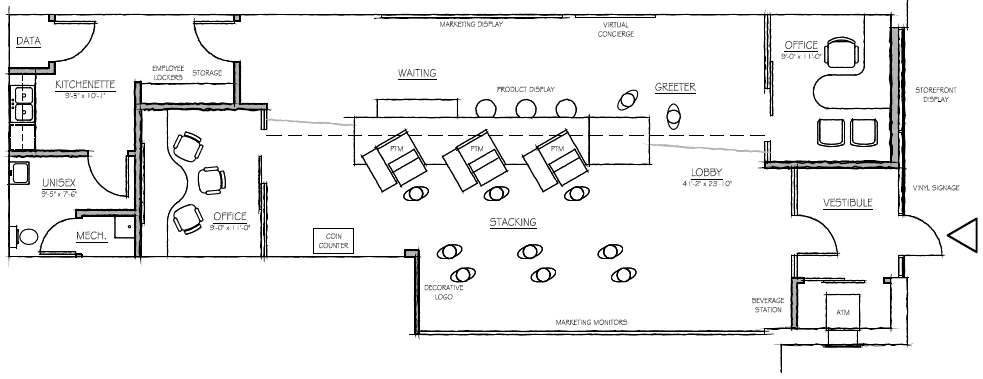

Shelby, MI - 1,476 Sq Ft

Alliance Catholic Credit Union partnered with La Macchia Group to expand into a new market, and to design and remodel a retail space that would support their vision.

Through La Macchia Group’s Strategic Market Analysis, it was recommended that Alliance Catholic enter the Shelby, Michigan marketplace as it had several parishes who were already members, making it ideal for their core SEG group. A retail storefront location was found to be the ideal branch size recommend for Alliance Catholic.

Because there was limited floor space within the storefront, La Macchia Group implemented large glass partitions and large windows, to allow an abundance of natural light which makes the room feel much larger. Environmental branding elements were implemented through the use of bright colors and finishes that complemented the Alliance Catholic Brand.

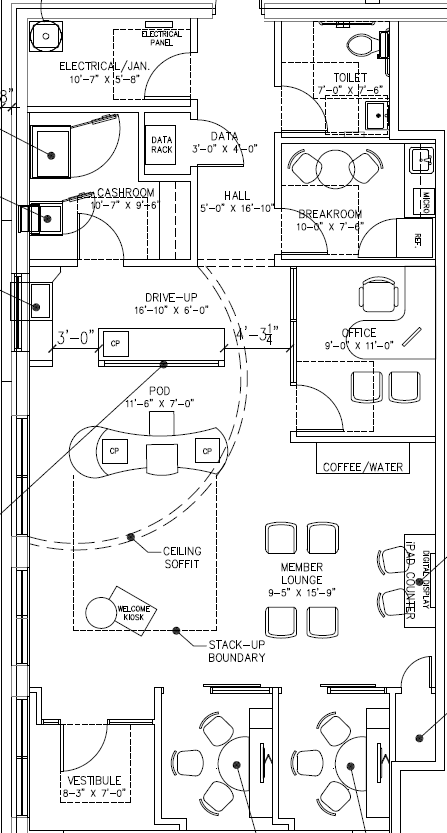

COASTAL CREDIT UNION

Carrboro, NC - 1,402 Sq Ft

Coastal Credit Union partnered with La Macchia Group to help them identify a new location to expand their footprint, increase membership and introduce a new market to its branded, immersive financial experience. Through a market study, La Macchia Group was able to identify a storefront location in Carrboro to expand the Coastal CU market into the nearby University of North Carolina campus.

The overall footprint is approximately 1,400 square feet with 1,150 square feet dedicated to the lobby. This branch features two Interactive Teller Machines (ITM), two multi-purpose rooms, a coffee bar, greeter station and ample marketing displays.

UNITED ONE CREDIT UNION

Sheboygan, WI - 978 Sq Ft

UnitedOne Credit Union partnered with La Macchia Group to bring to life a new concept branch to the downtown Sheboygan area. This new microbranch features Interactive Teller Machine technology which allows the credit union to have extended member-service hours and operational efficiency.

Brand consistency was key to this new design format so that the uniqueness of the space was not lost, but rather an immersive experience.

.png)

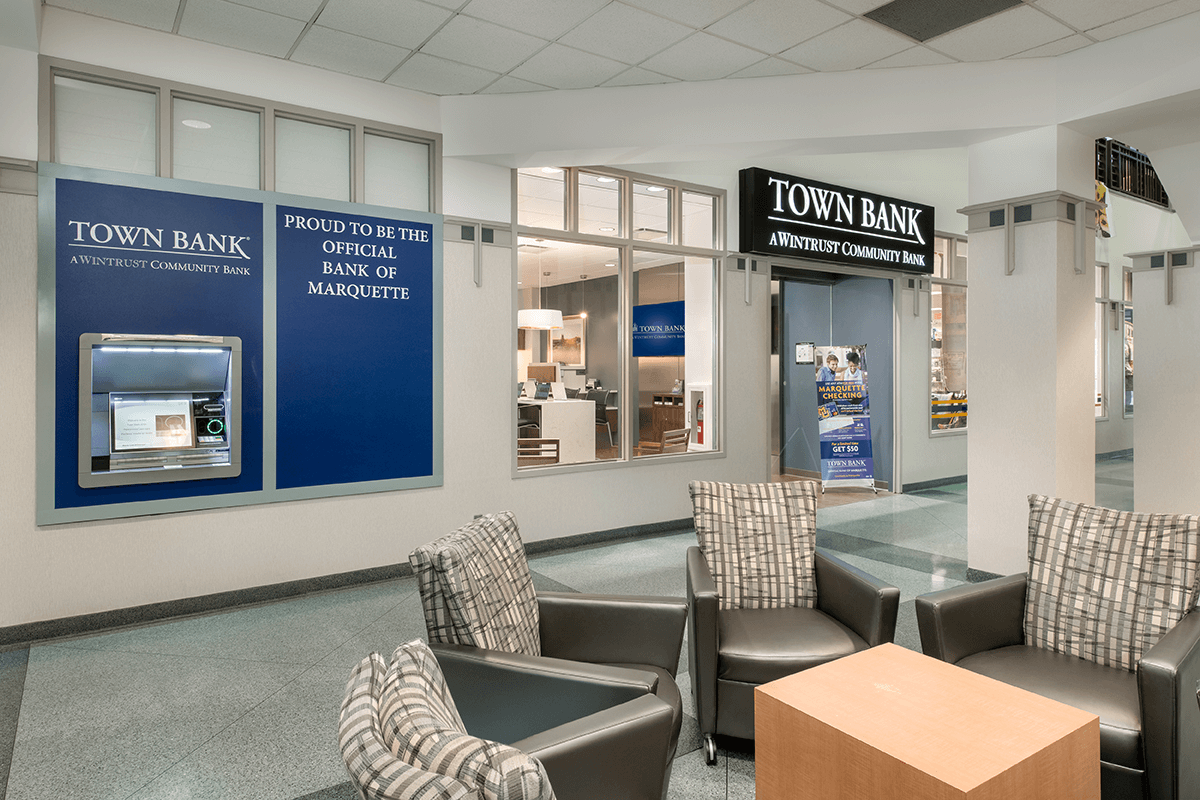

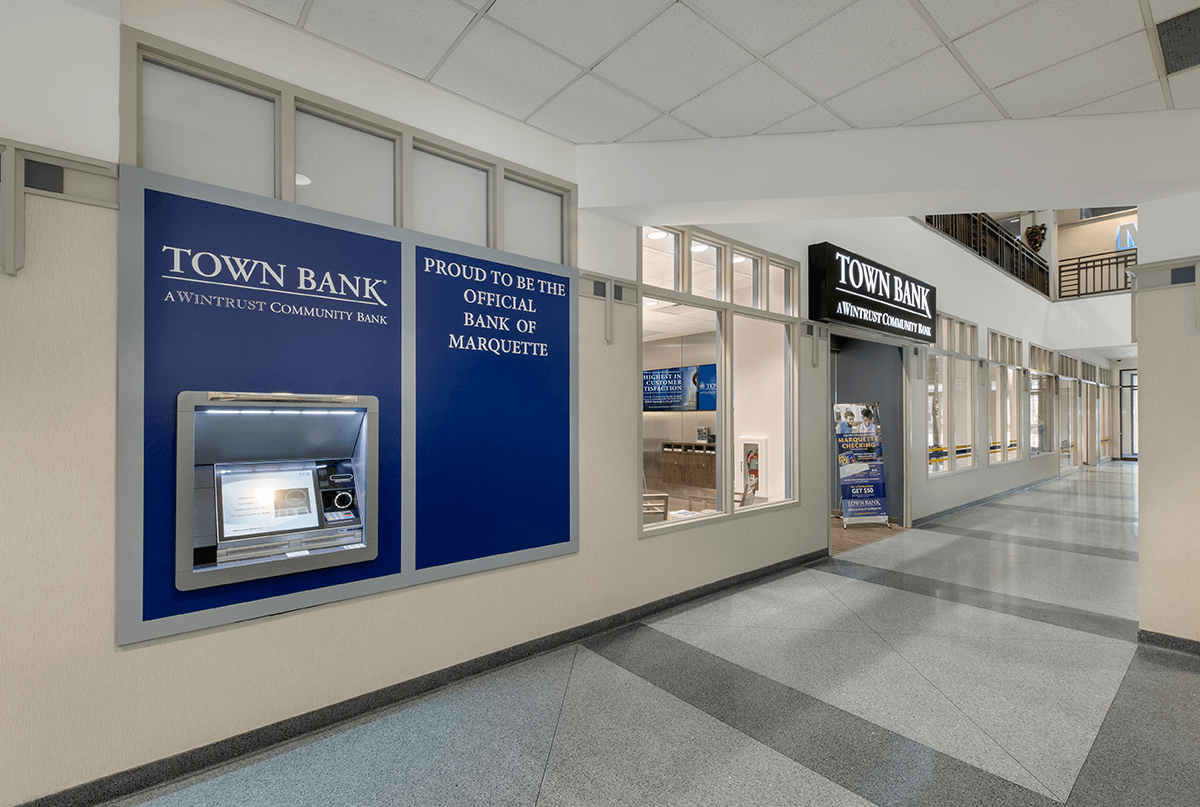

TOWN BANK

Milwaukee, WI - 754 Sq Ft

Town Bank had a unique opportunity to expand their market and increase their customer base by partnering with Marquette University. The Town Bank team brought in experts from La Macchia Group and with a well-rounded partnership, were able to meet customers where they live, work and go to school all in one place.

Since the overall footprint of this branch is less than 800 square feet, La Macchia Group’s design team decided to use light modern finishes and bright field colors with darker casework accents to ground the space. This branch also features large monitors that can display marketing material, as well as project the Marquette games for entertainment purposes. An exterior ATM was also installed with easy accessibility in mind, considering this locations' high visibility with customers always on the go.

THE VIVALOCITI DIFFERENCE

YOUR ACCOUNT TEAM