FEATURED in CUToday: 100 Million Members: Now What?

by Nina PensonMILWAUKEE, Wis. — When members never set foot in a branch, they often never put the credit union first in their thoughts. If a credit union wants walletshare among new members, it means a new emphasis on education and communication is required, with both members and employees, according to one person.

Dave Throndson, SVP of Sales with La Macchia Group, outlined several steps he believes credit unions can grow walletshare, provided the right strategies are deployed. Throndson shared his thoughts as part of the CUToday.info series on “100 Million Members: Now What?”

CUToday.info: Why are credit unions so good at signing up new members, but then not capturing wallet share from those new members? Is there a flaw in the process? Training? Culture?

Throndson: Many credit unions simply don’t have the resources to blanket their markets the same way as larger national banks on exposing consumers to the numerous options that they offer. Banks have conditioned consumers for decades on the array of products that they offer, however, credit unions have not collectively been able to create as much of a one-stop shop reputation to the general public.

This makes it more important that the employees of credit unions recognize this and place more emphasis on educating members about the additional products and services that they offer. Most credit unions receive upwards of 100 or more opportunities per day to expand PFI relationships and increase walletshare. These are opportunities that can be maximized by supporting spaces, such as the lobby, having been designed to have areas for better employee/member engagement.

Credit unions sometimes do such a good job of making it easy to apply for and obtain an initial loan that the new member neither sets foot in a branch nor has any direct communication with credit union personnel. Therefore, the new member doesn’t know about the other products and services that the credit union offers that they may find useful.

CUToday.info: Are credit unions capturing the data they need to have a full understanding of individual member profitability? Or do they have the data they need and it’s not either A) understood, or B) utilized?

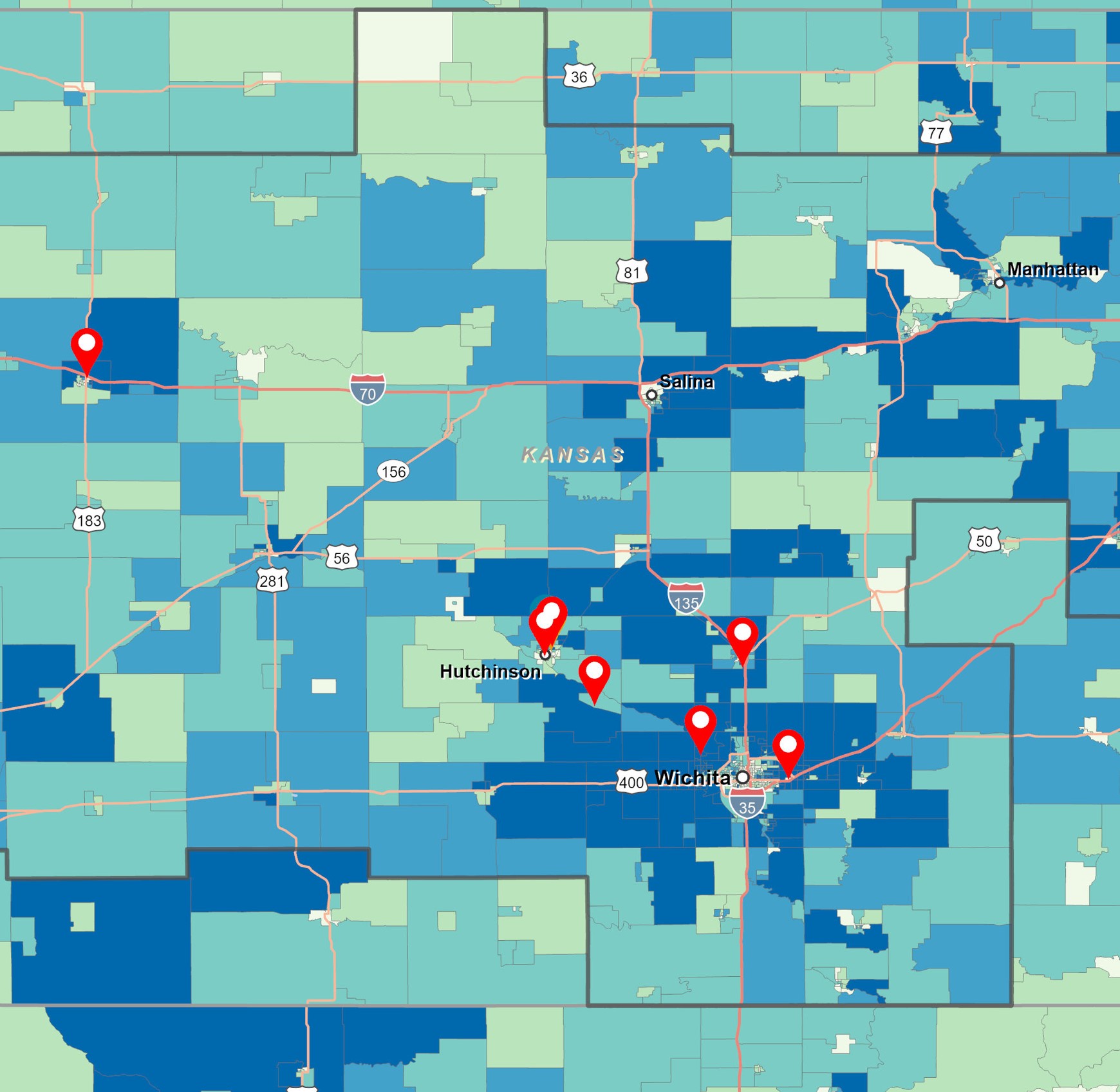

Throndson: There is a lot of information out there for credit unions to analyze, but the biggest challenge may be the interpretation of member attribute information and understanding what it means. Credit unions are great at understanding the qualitative side of their business. This can include the types of members that enter their door and the standard of care that is used. However, universally better understanding the information can mean reviewing it both visually and quantitatively as it relates to the credit union’s geography and member footprint within that geography. By credit unions better understanding their membership and its footprint they can then more successfully plan for branch networking.

Very large organizations may have the resources to hire people whose responsibility is analyzing membership and how it relates to the future of the organization. However, even large credit unions may not have the resources to drive the analytics needed to fully understand membership patterns. This is where trusted vendor partners can serve a role in helping all types of credit unions sift through the data to determine which members are the most profitable and how this relates to serving them, whether it be through branching or e-forums.

CUToday.info: What can be done to improve wallet share capture among new members? Existing members?

Throndson: It’s important for credit unions to understand and remember that the members select them, not that they select their members. How do you manage their experience with you when they engage with you? Try a simple experiment if you’d like a glimpse into this. Sit in your car in the parking lot and watch the members as they walk in. Are they frowning when they come in and smiling when they leave? Or vice versa? Did you give them a smile or take one away? That can be a simple first step in making the decision to embark on better member relationship management. With a coordinated effort from all areas of the organization the employees can be developed to listen for opportunities in every conversation and then to respectfully act on them—creating a more enjoyable experience for the member and improving wallet share through better PFI relationships.

Visit CUToday to read the article here.

.png?width=248&height=73&name=Logo%20w%20Tag%20-%20Color@300x%20(1).png)