1. FIntech and Financials: Friends Not Foes

According to CB Insights, 2021 global fintech funding at the end of Q3 already nearly doubled 2020’s year-end total. With the surge in nontraditional fintechs capturing an increasing financial share of consumer activity, it is instinctual for traditional financial institutions to be on the defensive, viewing this “invader” as a threat. Where many see threat, we see opportunity.

According to CB Insights, 2021 global fintech funding at the end of Q3 already nearly doubled 2020’s year-end total. With the surge in nontraditional fintechs capturing an increasing financial share of consumer activity, it is instinctual for traditional financial institutions to be on the defensive, viewing this “invader” as a threat. Where many see threat, we see opportunity.

Smaller fintechs need access to consumers, and many credit unions need access to the nimble, dynamic technology that fintechs are built upon; these partnerships can be powerful. Fintechs help credit unions offer additional value to existing members under the same “roof,” strengthening relationships and retention. A fintech/credit union collaboration can power efficiency and improve member experience. When the right partnership is identified and established, the possibilities for growth are significant.

2. Integrating systems

Throughout my tenure in the financial services industry, I have seen the ripple effect of poor integration. Many traditional financial institutions have a lot of systems that simply don’t talk to one another, making internal and even external branch communications clunky. While inconvenient for employees, it can be detrimental to member retention.

Throughout my tenure in the financial services industry, I have seen the ripple effect of poor integration. Many traditional financial institutions have a lot of systems that simply don’t talk to one another, making internal and even external branch communications clunky. While inconvenient for employees, it can be detrimental to member retention.

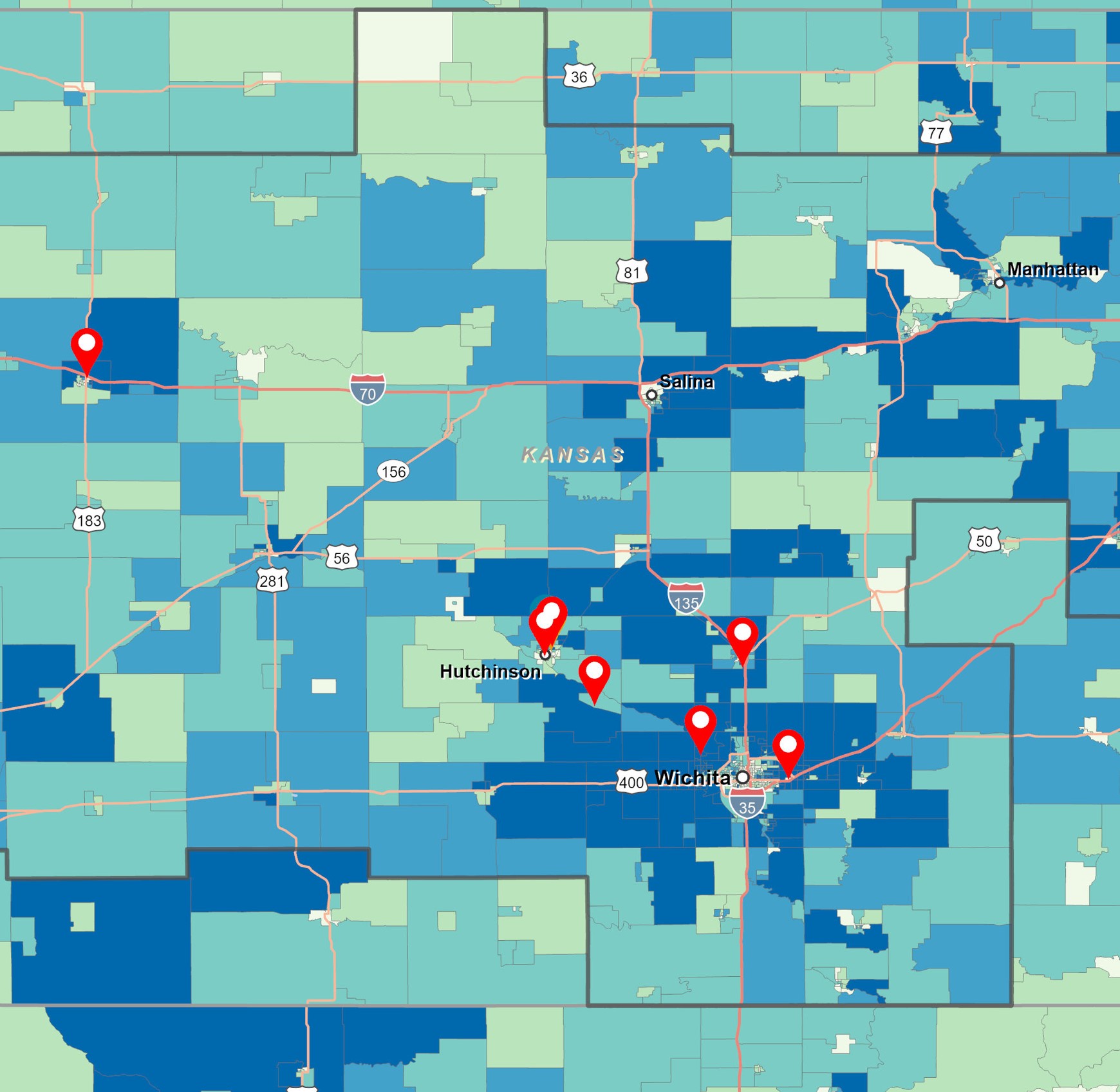

Conscious or not, humans have a deep-seated desire to be known, seen and understood. When systems are aligned to provide a 360-degree view of your member experience, you have the power to design experiences in real-time that meet members exactly where they are and invite them on a unique journey, crafted just for them. Properly integrated systems allow credit unions to harness the power of their own data, and leverage it to drive growth by creating seamless journeys that delight members and generate loyalty throughout all markets.

What does this look like in practical application? Maximizing your organization’s analytics allows you to dig deep into your data to fully understand your market presence and growth potential. In branch, you then have the power to adjust your environmental settings with smart technology, learning from employee and consumer usage in your space to drive efficiency and increase impact. Facilitating a two-way flow of information, sensors and beacons capture the data you need to drive content decisions and unlock powerful business intelligence. This is the future of the financial services industry.

3. High Tech Meets high Touch

Millennials and Gen Z individuals making the transition from college to young professional are met with a myriad of decisions, many rooted in their finances. From direct deposit set up and car financing options to retirement allocations, student loans and saving for a house down payment, this whirlwind can be overwhelming.

Millennials and Gen Z individuals making the transition from college to young professional are met with a myriad of decisions, many rooted in their finances. From direct deposit set up and car financing options to retirement allocations, student loans and saving for a house down payment, this whirlwind can be overwhelming.

It is time to change the narrative when it comes to communicating with young borrowers at this stage of life. These individuals often aren’t interested in or thinking about the products and services that a credit union offers, rather solutions to the pressures and pain points that they are navigating as they progress in their financial journeys.

Yes, they desire all of the bells, whistles and conveniences of dictating their own financial experience across different channels and platforms, with the expectation of a seamless transition from each, but that’s not enough. It needs to be coupled with the guidance of a trusted source who has access to experience that they just don’t have yet; that’s a game changer.

For example, according to Credit Karma, 60 months of financing through a credit union on a $25,000 new vehicle could save a member upwards of $700 in interest over the life of their loan, compared to average bank rates. Imagine yourself as a new professional sitting across from a trusted advisor and hearing you could save around the equivalent of a mortgage payment in five years based on a single financing decision; that’s the stuff of long-term relationships.

.png?width=248&height=73&name=Logo%20w%20Tag%20-%20Color@300x%20(1).png)

According to

According to Throughout my tenure in the financial services industry, I have seen the ripple effect of poor integration. Many traditional financial institutions have a lot of systems that simply don’t talk to one another, making internal and even external branch communications clunky. While inconvenient for employees, it can be detrimental to member retention.

Throughout my tenure in the financial services industry, I have seen the ripple effect of poor integration. Many traditional financial institutions have a lot of systems that simply don’t talk to one another, making internal and even external branch communications clunky. While inconvenient for employees, it can be detrimental to member retention.