' />

' />

Most often, when consumers pay a visit to their local bank or credit union branch, their goal is to get in and out. Instead of settling for your branches being a pit stop, can you make them a destination? Of all your channels, branch banking has the highest potential to make an impact through a delightful customer experience, keeping them coming back for more by establishing loyalty, trust and confidence in you.

In this brief overview, we’ll show you how a simple finding from psychology can help you transform your retail banking experience.

Think back to your middle school years. What do you recall? The fun events of the last day of school? The A you earned in one of your hardest classes after studying for hours? The concert when you tripped on the stairs in front of everyone? Whatever your unique memories, you likely don't remember EVERYTHING, but you do remember the highs and the lows. It's these highs and lows that define your experience, rather than some averaged emotional index spread out over months and years.

Let’s draw the same parallel for the customer experience by focusing on what the human brain actually remembers and why. If your branches are designed to facilitate transactions, its likely you've tried to make that as easy as possible. But that frictionless experience has now become the mid-day math class we struggle to recall. It wasn't bad, it just wasn't worth remembering. The banking app you've invested so much in? It was designed to facilitate transactions and be easy. Your users can only recall the last thing they did, but not the hundreds of times they logged in without fail in the past year. Why is that?

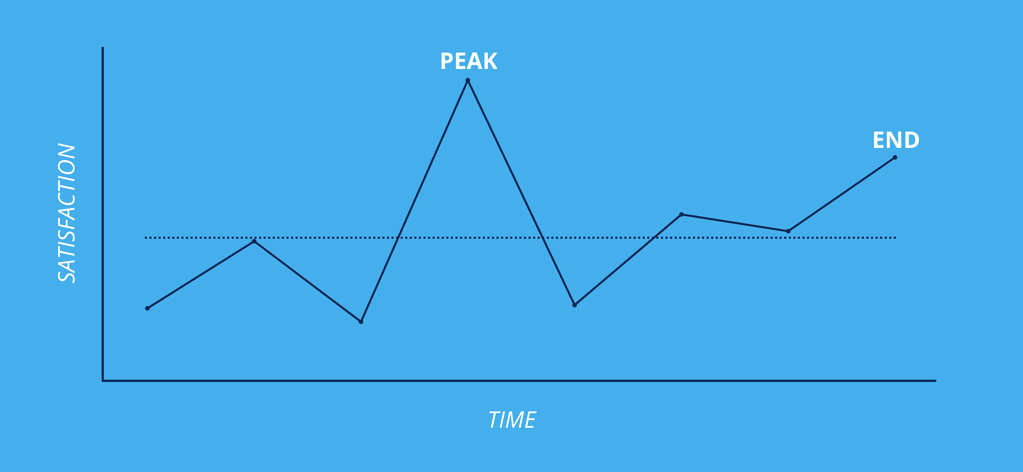

Mostly, with one more element. The Peak-End Rule was founded and tested by Daniel Kahneman, a renowned psychologist known for his work on the psychology of judgment and human decision-making. As defined by the Nielsen Norman Group (NN/g), the Peak-End Rule is a cognitive bias that impacts how people remember past events.

Intense positive or negative moments (the “peaks”) and the final moments of an experience (the “end”) are the most heavily weighted in our "mental calculus". What we recall is limited and incomplete, but accurate in our own minds.

While serving consumers on the go and reducing friction in today’s busy and dynamic economy is important; it's not enough to be memorable or to generate connection and loyalty. Your branches provide you with unique opportunity to give people something unexpected and delightful to remember, improving your retention efforts and long-term growth.

Your peak moments from middle school may have been chance or good/bad luck, but creating positive peaks for your customer or member experience has much better than 50/50 odds. There is proven science behind why peak moments exist and what triggers them.

To activate the positive peak, memorable moments for visitors who step foot into your branches, at least one of the following four elements must be present during an event:

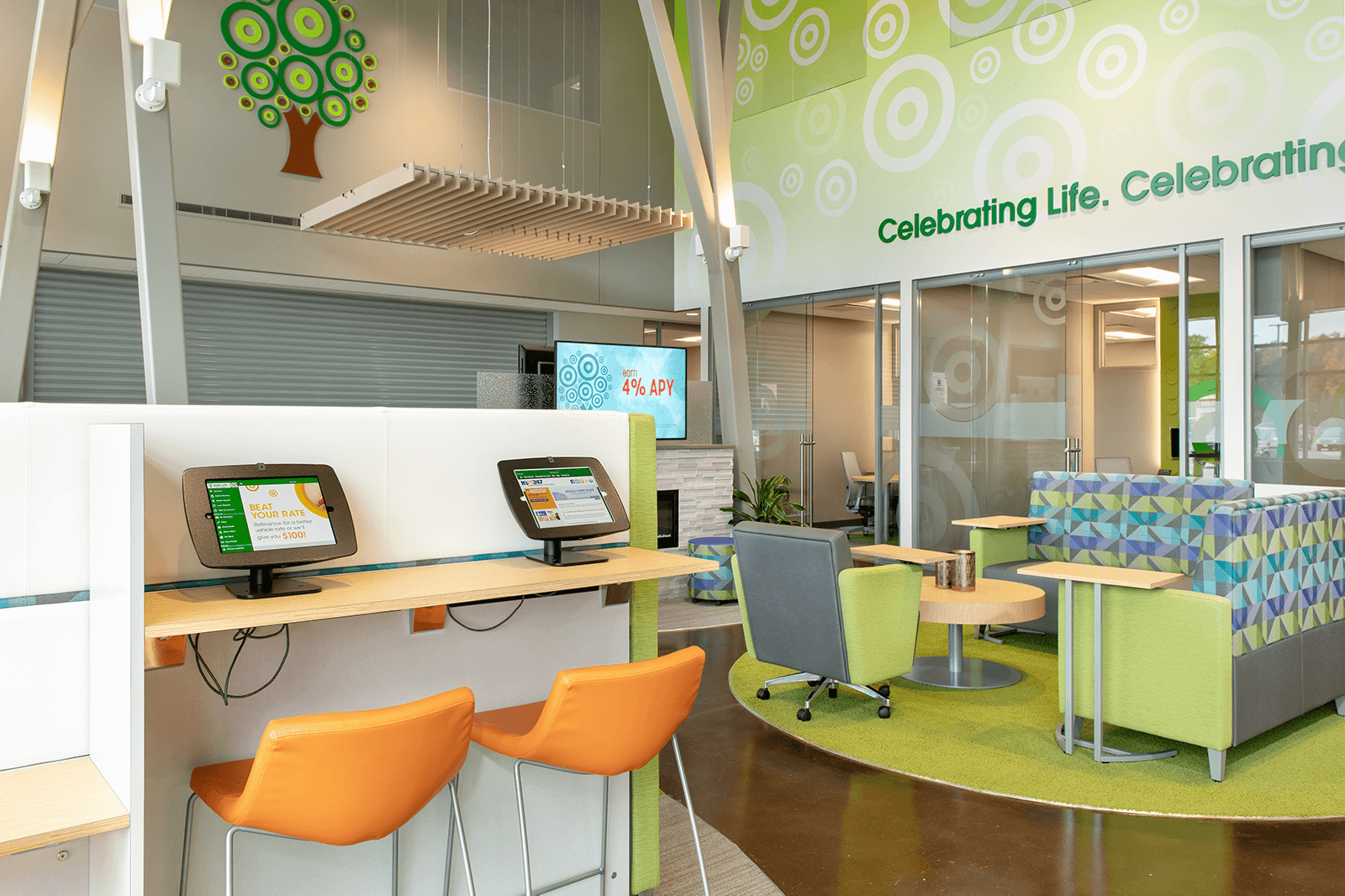

Elevation

This refers to "moments of happiness" where expectations are exceeded through sensory stimulation, generating surprise. Imagine the exterior of your buildings. Consumers may not expect much, but instead they drive up and are greeted with colorful branded elements, and creative touches that spark joy. This is what helped Park City Credit Union (left) leverage their building as their most powerful billboard to drive market interest and growth. Imagine walking in an being greeted by music or a stunning visual display - unexpected, joyful sensory experiences that on the surface simply brand the space, but do so much more to connect with visitors in a meaningful way.

Pride & Connection

Pride refers to those moments we relish because we were at our best, achieved our goals or triumphed over challenge; while connection refers to moments that are social in nature and valued in culture. While seemingly obvious, they are often overlooked in retail experience design and lifestyle content.

One of the best retail experiences can be found by looking at how Lululemon Athletica, a well-known athletic apparel retailer, uses their brick-and-mortar space to deliver in-store community experiences to their customers who want to feel a part of something bigger than themselves, according to Quarter20. How does Lululemon do this? By staying true to its mission of: Giving consumers the tools and opportunities to become their best selves. Lululemon offers free events such as yoga and wellness classes in-store, therefore empowering connection between the business and its customers while encouraging customer to customer interaction as well. When people feel a part of a community, and complete a class, Lululemon is fueling both connection and a sense of pride.

With this example in mind, its clear to see why bank and credit union brands are embracing space co-habitation, featuring "community member of the month" boards, leveraging their apps to "gamify" and reward financial achievements and are opening up meeting spaces to community members.

One of the most clever, and very subtle ways of connecting to pride in the financial services industry is allowing account holders to name their accounts. The "15th anniversary trip" savings account or the "Gina's first car" account represent moments of pride and achievement, connecting that financial brand to powerful life moments.

Reliant Credit Union is also an excellent example of helping members visualize those powerful life moments through its new brand messaging and video (above). It reassures members that they can forge their own paths in life, and do more than they ever imagined with Reliant as their partner. The examples and opportunities to deliver on these messages in retail environments is only limited by our creativity.

Insight

These exceptionally powerful moments are rare; the moments we stand back and shout "Eureka!" These moments change our view of ourselves or the world around us, they inspire or alter us, providing resounding clarity. As retail spaces dabble in more technology-driven solutions that augment product and service advertising, giving products a purpose through the creation of relevant content helps consumers visualize what they want/need and tell the stories that inspire them to say "I can do it (too)."

Community engagement and storytelling, and using retail spaces as a vehicle for that, are a means of enabling those insightful moments. In other cases, creating clean, safe, beautiful spaces for those in underserved communities can fuel life-changing financial moments as well, when expectations may have been low but hope high, and the reception from the financial was warm and inviting.

|

|

|

|

Banking will continue on its rapid path of evolution and meeting the needs of more people world-wide. Financial leaders must embrace this through innovative ideas and thinking outside the box with how they choose to improve the customer experience. Being the change your consumers want to see will produce positive results (and peaks) and shouldn’t be seen as a threat to tradition.

For more inspiration on how to identify your peaks, create those memorable moments and end them on the highest possible note, download our free infographic.

Creating Peak Moments For In-Branch Experiences

As featured inCU Insight, June 4, 2020: Leveraging Technology To Enhance Branch Health And Safety

Over the years, the financial industry has been transformed with digital innovation and evolving...

MAIN OFFICE

157 North Milwaukee Street

Milwaukee, WI 53202

phone: 414.223.4400

fax: 414.223.4488